As a first-time entrepreneur, 20 plus years ago, I had not even the faintest idea of the difference between a business and a revenue model. However, I soon realised that there was a significant difference. If I was to get anywhere in structuring a winning revenue and business model for my startup and finding funding, I had to know why each of these models were important and how to pitch them to an investor.

What’s the difference?

Most people define a business model as the company’s way of making money. But there’s much more to the business model than meets the eye. Let’s first understand the differences before we dive deeper into what investors look for when evaluating a startup.

A business model is how the company creates, delivers, and captures value.

A revenue model is how a startup generates revenue from the value it creates for its customers.

Founders engaging for the first time with an investor need to have a well-designed and efficient business model as there will be many questions at the first meet. And if your 5 min elevator pitch is a success, you’ll get invited for a meeting. If your startup lacks any of the essential elements of a business and revenue model, you will struggle to capture any investor’s attention.

An investor evaluating a prospective investment has to reduce investment risk by looking at a couple of vectors. Without a revenue model, the business model will not work. When you first start, make sure you get these right, and you are sure to increase your chances of success both with getting funding and happy returning customers.

Should we design a sustainable business model?

Of course, yes! With sustainability being such a hot topic and with Kavedon’s circulatory ethos, we must design even business models with sustainability in mind. When we create more value than we capture and capture more value than it costs to deliver, we have a sustainable business model. Keeping this equation in mind, let’s dissect the business model further.

Sustainable Business Model = Created Value > Capture Value > Cost of Delivery

What is a business model?

Nine individual components describe and assess a business model. It involves identifying customer segments, customer relationships, value propositions, delivery channels, key resources, key activities, key partners, cost structure, and revenue model.

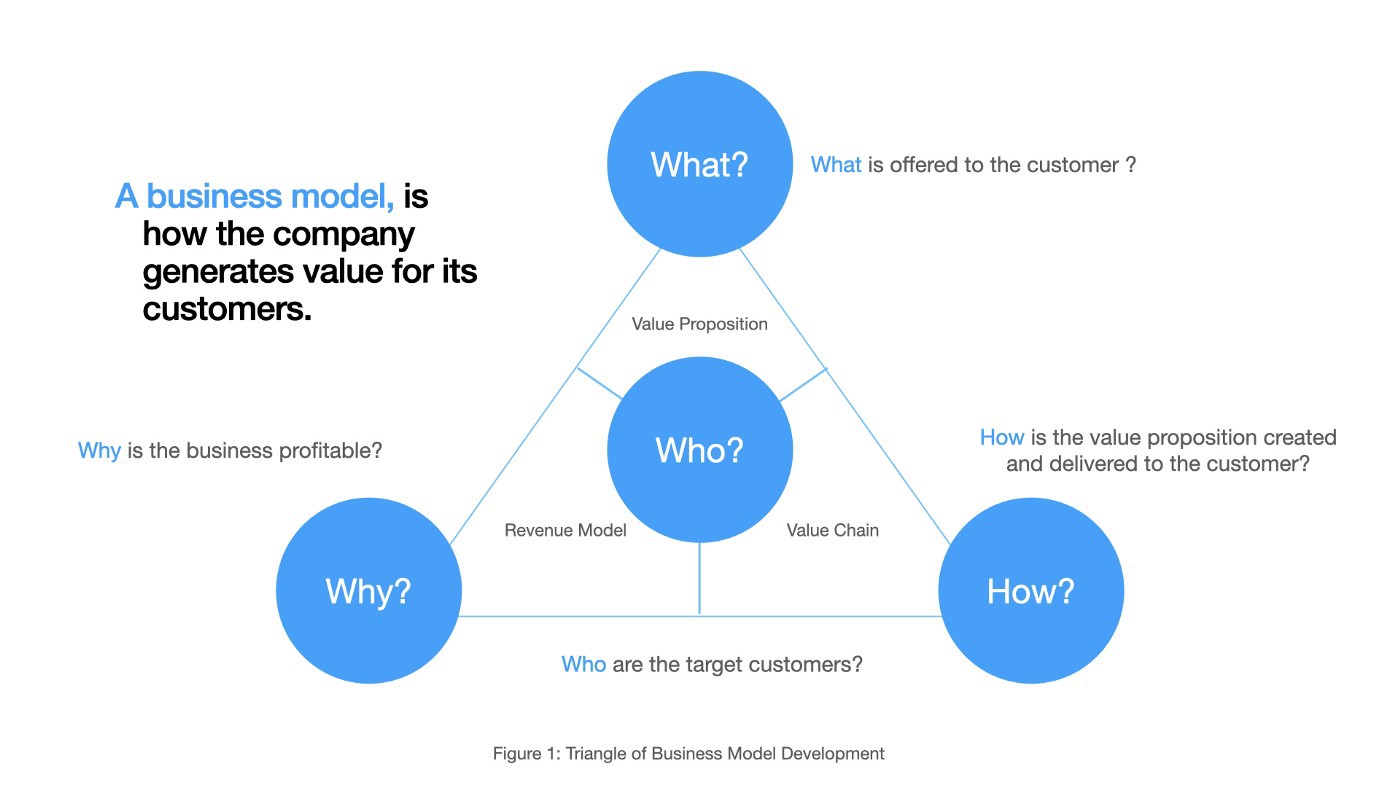

An intelligent founder can design a superior business model by using the following magic triangle and slotting these nine activities into four individual components of a business model: Figure 1 — Triangle of Business Model Development (own illustration based on Business Model Navigator.)

- WHO are the target customers? (Customer segments and relationships)

- WHAT is offered to the customers? (Value propositions)

- HOW is the value proposition created and delivered to the customer? (Key activities, partners, and resources)

- WHY is the business profitable? (Cost structure & revenue model)

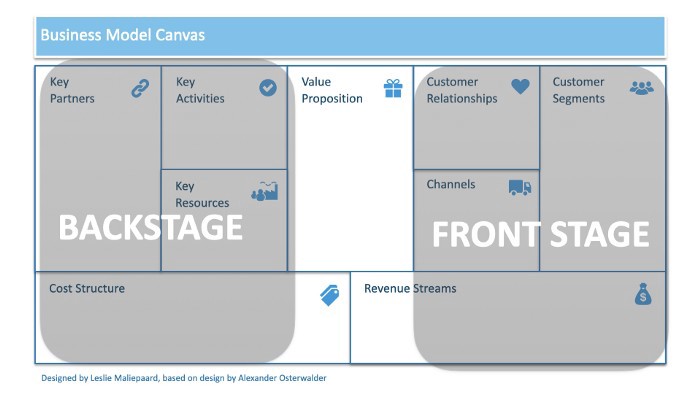

Figure 2 – Using the Business Model Canvas (BMC) developed by Alexander Osterwalder) is worthwhile.

The BMC is a typical tool used for helping entrepreneurs develop different ways of structuring a company that solves a problem, adds value to its customers, and delivers a profit. Osterwalder talks about the “front stage” and “backstage” sides of the business model canvas. The front stage is everything to do with the customer-facing elements of the business, and backstage handles all the aspects of the business process.

In other words, the front stage is customers, relationships, channels, and revenue (the right half of the canvas). Backstage includes partners, key activities, key resources, and cost (the left half of the canvas). And the essential “value” part is in the centre of it all. Founders need to ensure that both sides of this model, the customer aspects and the business aspects are in alignment for an efficient model.

Why do we need a business model?

To better understand how the Business Model Canvas works, I have an exercise for you. Take some time out of your day, grab a cup of coffee, sit down in a quiet place, and apply the Business Model Canvas to your business. Using this tool will make it easier for you to apply the logic to your own business. It’s a valuable exercise to do at the beginning or at a time of misalignment in your business since it can help pinpoint a troublesome area that needs innovating.

When one component of the business model changes, it often leads to a change in other parts. A change or innovation in the revenue model often can effect change across the company’s entire business model. So, if you have been struggling to gain traction or received feedback that your business and revenue model are misaligned, take comfort that it’s happened to the best.

For example, PayPal, Apple, and YouTube were flexible enough to change their strategies, proving to be a significant asset. PayPal, founded in 1998, was initially meant to be a cryptography company and then later a mechanism of transmitting money via PDAs. Yet after several years of trial and error, PayPal discovered a working business model as an online payment system that allowed them to go public in 2002.

Apple was also failing at consistently generating a profit from about 1993 to 1997. After several internal issues, Steve Jobs left but later returned in 1997 and led the company through a drastic change in Apple’s business model and, the rest is history.

The Takeaway

The essence of a successful business model is how an organisation creates, delivers, and captures value. And when you make a business strategy that goes beyond the revenue model and technology, you create a more holistic business. You don’t have to operate under a single business model. Companies today can have a few business models.

Lastly, don’t forget that businesses often need to revise and update their business model to stay current and prepare for changing markets. This way, you can power a successful business and deliver value to the company, investors, and customers.

Article by