Venture capital firms talk about proprietary deal flow all too often; deal flow is the metric used to measure access to market when looking at start-ups and considering them for investment.

Deal flow, particularly when wrapped up with the ‘proprietary’ title, to a venture capital partner acts as a way to claim a level of priority (i.e., first access to deal flow, proprietary) as one of the main ways to raise Fund capital from Limited Partners. The VC firm then manages and puts that deal flow into their portfolio. There are other specific reasons that investors may invest, but deal flow is one of the main ones.

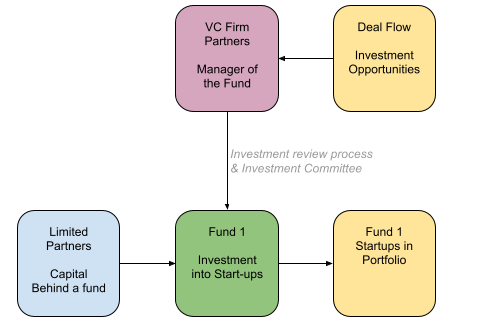

For those of you that do not know (especially our readers who may be first-time founders) let us explain a super simplified way of understanding this:

The above shows a simple overview of how the market currently views the process of what is known as deal flow. Start-ups out there are discovered and venture capital partners following a transactional process, promote these chosen investment opportunities to the Fund.

The Limited Partners choose the Funds they invest in, because they believe in the ability of the VC partners to source good investment opportunities which are accretive to the Fund’s Portfolio. The VC partners are compensated through an annual management fee (normally about 2% of the Limited Partners investment) for the lifespan of the Fund. The management fee is to cover the operational costs of maintaining the Fund and supporting the Portfolio until exits occur.

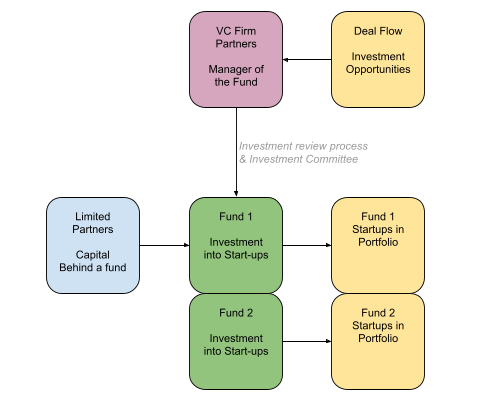

As diagram 2 shows, when a new ‘Fund 2’ is created the same process is followed. With the ‘Fund 1’ track record not being created as yet, the confidence in the ability to source deal flow still remains one of the most important factors for attracting the Limited Partners. Why do the VC partners want, or need to create a ‘Fund 2’, when ‘Fund 1’ is still operational, and its portfolio investments are unlikely to have shown clear results as yet?

The ‘normal’ venture model is based on the 2 and 20 model. That is, a 2% annual management fee and 20% performance fee. The day-to-day salaries and expenses of the partners and team come from the annual 2% management fee. The performance fee, 20%, is determined against the actual returns from the performance of the Fund, so this comes later down the line. The 2% is the bread and butter to run the operation. So, the more Funds you can build, the more management fees you can create, or ‘stack’, in order to extend the 2% fee runway and preserve the existence of the partner team, and so on.

So, if deal flow is a main priority for converting investors, then you need to maximise deal flow, but when you are a limited size team of VC partners, priorities on your time also become stretched, particularly on day to day, hands on support and involvement with the portfolio. The 2% management fee structure only allows so much growth and time, if you have one fund. So, a focus on building further funds from an early point, becomes the norm. When you have Fund 2, the pressure and expectations start to build, but the same issues remain. Double the work but still a limitation on resources. This is a main reason why the linear model prevents the team spending 100% of their time on the portfolio. In many cases, VC teams spend less than 50% of their time. So, a numbers approach becomes attractive.

So, for a significant proportion of VC firms, the ability to build or ‘stack’ funds to enable ongoing fee income has become a priority for survival and growth, and therefore the focus on deal flow is seen as a numbers exercise. Founders themselves slip down the list of priorities.

Deal Flow, Doing What We’ve Always Done

Driving the use of deal flow as a viability metric, especially for emerging managers, has led to a greater chance of non-alignment over time between investors and start-ups. A loss of future growth for VC firms, and therein their investors. The growth journey should be one where the investor and fund manager are fully aligned with the founder, the human capital. When it becomes a numbers and fee focus, this leads to a breakdown in any opportunity for long-term vision. The linear model is realised.

Seeing deal flow as a metric leads to other issues too. This ‘normal’ model works in tandem with the initial belief that start-ups in general fail, so you need to have access to a large quantity, continually. Hence, why to date venture has been a powercurve asset class on returns (lots of losses, a few winners, 1 or 2 big yielding returns). With the growth seen in emerging venture capital funds, this view has become even more entrenched.

Venture capital as an asset class has performed well versus other assets and has therefore drawn attention to itself. With this growth, new managers have arrived, many investment individuals from other asset classes, many with no previous experience in venture. The majority follow the numbers approach — it’s an easier way. A majority have no founder perspective or relatability and therefore, no experience. This is not a direct criticism, but it continues to entrench norms and only distances founders further. The standard ‘norm’, that over 50% of venture investments fail, is now generally accepted. Again, it’s about metrics. A conveyor belt if you like. It’s not taken that VC fund resources are not being used efficiently to discover and grow companies, but the actual start-ups themselves that are at fault, they are already judged.

The loss potential of founders then becomes abundantly clear. Excluding founders so early prevents any positives in the future. We believe you need to bring in founders, they are the gold. A circular economic approach is all about transparency, community and networking, bringing in and supporting and referrals. Working off preconceived metrics prevents and restricts the opportunity for long term growth in our economies. In an ever-changing world, VC at the centre of innovation seemingly prefers to stick with its safer ‘normal’.

Now consider, the start-ups as both a conveyor belt metric ’Deal Flow’, and its impact of a power curve assets class with an accepted high failure rate; does inverting ‘Deal Flow’ to ‘Founder Flow’, and using the bias impact of positively impacting, by assisting founders, the human capital, create a safer yield trend. Causality would probably say yes, helping early teams makes a difference. As I’ve said before, if U.S. venture investment makes up only around 0.2% of GDP, but delivers an astonishing circa 20% of U.S. GDP in the form of VC-backed business revenues, how much more of a difference could it make if approached from a more qualitative perspective in general.

When founders are broken down into the metric of deal flow, it creates a vanity metric without recourse of thought about a longer-term impact of the human connection to a venture capital fund, the founders can deliver. Venture in the majority has become a numbers game, where it is obvious to us that venture is an asset class where human interaction drives the biggest shift in bias to the benefit of all concerned. This is the way Kavedon sees it. Short term vanity metrics limit long term growth opportunities. This is why we do not see start-ups as deal flow, but as founder flow.

Founder Flow, Not Deal Flow

Why is it important to consider such a mindset change? Founder flow has the potential to provide multiple deals (i.e., Deal Flow). By retaining a relationship with a founder, funds are more likely to understand them as human beings, what their skills capabilities are.

Doing so will stop the need for early start-up teams to feel like they need to market and dilute their capabilities to get access to capital, removing any artificial bias in the review process, allowing venture teams to consider the positive bias impact they can put on the founders to get them in a stronger position for success — thus adjusting the assets class returns profile.

Kavedon’s fund team all have founder experience. They see the person behind the start-up. That’s why our whole fund team spends 100% of their time focused on that founder relationship, journey and community. Kavedon is built to enable this focus specifically. It is strange to think this would not be the case, but the inefficiencies of the current ‘norm’, prevent it for the majority. To truly support solid growth in companies and therefore the resulting returns, you have to see the founder’s perspective, build that relatability and generate that experience. Then this brings us back to understanding perspective, and so on as the community grows.

Kavedon Kapital’s circular economics approach brings Founder Flow into play, dispensing with the vanity metric approach. Kavedon sees start-ups as Founder flow, we build a community, align, invest and support the journey and retain this experience within our community for the future to help build the future generations.

The journey should be an aligned one, between the investors, founders and fund team. Not a journey from one point to another, then move on. Yield and return are paramount, it’s an investment, but so also is the experience of the actual founders. The ability to be in a position to retain this relationship, what we call Founder Capital, is as important as being able to retain a partner’s investor relationship.

When you invest, you invest in people. It’s the people you want to understand. A founder is so much more than a one-off start-up that succeeds or fails. It’s the experience and knowledge the founder develops during the journey and the journey can go on and on.

Article by

More recently over the last 12 years, I have been involved in investing in and building businesses, as well working with and discovering founders and entrepreneurs across Europe. A strategic networker, I have assisted in raising funds and advising companies. During this time I have been engaged as CIO with a European Family Office and the creation of an Austria Venture Fund vehicle and Accelerator, for a Corporate entity.